Thirty percent. That’s how much revenue some practices lose annually to preventable billing errors, claim denials, and revenue cycle inefficiencies. Not because they’re bad at medicine. Because managing medical billing and coding internally is a specialized skill set most practices don’t have the capacity to master.

You treat patients brilliantly. You run a tight ship operationally. But somewhere between the treatment room and your bank account, money disappears. Claims get denied. Payments get delayed. Revenue leaks through cracks you can’t even see.

Let me show you exactly where that 30% goes, and how outsourcing medical billing plugs every single hole.

The Coding Errors That Cost You Thousands Weekly

Your internal biller codes a visit with multiple procedures. She bills them separately. The claim gets denied immediately. Why? Those procedures should have been bundled under a single code. The payer’s automated system caught it instantly.

She doesn’t know the National Correct Coding Initiative (NCCI) edits. She doesn’t have time to cross-reference every code combination. She’s managing thirty other tasks while trying to get claims out the door.

The revenue impact:

- Average claim value: $350

- Claims affected per week: 15

- Weekly loss: $5,250

- Annual loss: $273,000

Professional medical billing and coding services employ certified medical coders who know NCCI edits by heart. They catch bundling issues before submission. Your claims go out clean. You get paid the first time.

Modifier Mistakes That Leave Money on the Table

Modifiers change everything. The wrong modifier means an automatic denial. A missing modifier means reduced payment. Your biller doesn’t always know which modifier to use because payer requirements differ and change constantly.

Common costly error with billing:

- Missing modifier 25 on E/M services with procedures

- Incorrect use of modifier 59 vs XE, XS, XP, XU

- Missing modifier 76/77 for repeat procedures

- Wrong modifier for bilateral procedures

Medical billing companies stay current on modifier requirements for every major payer. Their coding specialists apply the right modifiers every time. You get full reimbursement instead of partial payment or denial.

Medical Necessity Documentation Gaps

Your treatment was medically necessary. You know it. But your documentation doesn’t support the diagnosis code properly. The claim denies. The payer wants their money back. You’re stuck in an appeal you’ll probably lose.

This happens constantly with internal billing. Your medical billing specialist doesn’t have clinical training. She can’t recognize when documentation doesn’t support the code. She submits it anyway. You lose.

External medical coding services employ certified coders who understand clinical documentation requirements. They flag insufficient documentation before submission. You fix it upfront. The claim pays.

The Timely Filing Deadlines You’re Missing

Most payers have 90-day timely filing limits. Some have 60. A few have 180. Your internal team can’t track all these varying deadlines while managing daily claim submission.

A claim gets denied. Your biller is busy with new submissions. She doesn’t appeal within the deadline. That revenue is gone forever. Multiply this across dozens of claims monthly, and you’re looking at five-figure losses.

How much this costs:

- Average denied claim value: $425

- Missed appeals per month: 20

- Monthly loss: $8,500

- Annual loss: $102,000

Medical billing outsourcing companies use automated tracking systems that flag approaching deadlines. Every denial gets appealed promptly. Recovery rates jump from 15% to 70% because professionals handle it systematically.

The Submission Delays That Snowball

Your biller took vacation. She got sick. She’s training a new hire. Claims from three weeks ago still haven’t been submitted. When they finally go out, several are past timely filing. You never collect that revenue.

This happens to every practice managing medical and dental billing internally. Life happens. Staff shortages happen. Revenue loss happens.

External billing eliminates this completely. Claims go out within 24-48 hours of service. Every time. Regardless of staffing situations. Your timely filing risk drops to nearly zero.

The Denial Management You’re Not Doing

Your internal team receives a denial. It requires specific documentation, a written appeal letter, and payer-specific forms. Your biller looks at it, gets overwhelmed, and moves to easier tasks. The denial sits. The deadline passes. The money evaporates.

Industry statistics show practices appeal less than 40% of denials when managing internally. Professional billing and coding companies appeal 95% or more because they have dedicated denial management teams.

The math on this is devastating:

- Monthly denied claims: $35,000

- Internal appeal rate: 35%

- Amount appealed: $12,250

- Amount never pursued: $22,750

- Annual abandoned revenue: $273,000

The Appeals That Fail Due to Inexperience

Your team does appeal some denials. But they don’t know what documentation the payer needs. They don’t know the magic language that gets claims overturned. They don’t know which denials are worth fighting versus which to write off.

The appeals fail. You assume the denials were legitimate. They probably weren’t.

Medical billing companies employ specialists who appeal denials full-time. They know every payer’s appeal process. They know what works. They recover 60-70% of denied claims because they’re experts at it.

The Credentialing Lapses That Stop Payment

Your provider’s credentialing with a major payer expired. Nobody noticed until claims started denying. Now you have three months of unpaid claims that need manual review and reprocessing. Some will never be recoverable.

Credentialing lapses happen constantly when practices manage it internally. Someone forgets to track renewal dates. Applications sit incomplete. Payer follow-ups don’t happen. Revenue stops flowing.

The immediate impact:

- Three months of claims: $150,000

- Percentage unrecoverable: 20%

- Lost revenue: $30,000

- Plus the time cost of fixing it: Incalculable

Professional credentialing services track every provider, every payer, every expiration date. Renewals happen proactively. You never lose in-network status. Claims never stop paying.

The New Payer Enrolments That Take Forever

You want to join a new insurance network. Your internal team submits the application. It sits for months. Nobody follows up. You’re missing out on an entire patient population while your application gathers dust at the payer.

External billing partners have dedicated credentialing specialists who follow up persistently. They know who to call. They know how to escalate. Your enrolment happens in weeks instead of months.

The Front Office Chaos That Costs You Daily

Your front desk is supposed to verify insurance before appointments. They’re swamped. They verify eligibility but not benefits. Patient arrives. Gets treated. Claim denies. Service isn’t covered. Now you’re collecting from the patient. Good luck.

Verification failures create massive bad debt:

- Percentage of services not covered: 8%

- Patient collection rate: 35%

- Effective loss: 65% of uncovered services

- Annual impact: $85,000+

Front office management through professional services means systematic verification of both eligibility and benefits before every appointment. Coverage gets confirmed. Financial responsibility gets discussed upfront. Bad debt drops by 60%.

The Eligibility Checks That Don’t Happen

Your schedule is packed. Your front desk is overwhelmed. They don’t verify insurance for same-day appointments. Patient arrives with terminated coverage. You treat them anyway because they’re already here. Claim denies. You eat the cost.

This scenario plays out multiple times weekly in practices without external medical billing support. Professional billing partners verify eligibility on every patient, every visit, no exceptions.

The Payer Underpayments You Never Catch

Payers make mistakes. They underpay claims. They apply wrong fee schedules. They “accidentally” reduce reimbursements hoping you won’t notice. Your internal team doesn’t have time to audit every payment against contracted rates.

How much this costs you:

- Claims underpaid: 12%

- Average underpayment: $45

- Monthly underpaid claims: 180

- Monthly loss: $8,100

- Annual loss: $97,200

Medical billing outsourcing companies use automated payment posting systems that flag underpayments instantly. They pursue every discrepancy. You collect what you’re actually owed.

The Contract Rate Errors Nobody Questions

You have a contracted rate of $250 for a specific procedure. The payer pays $210. Your internal biller posts it and moves on. She doesn’t realize it’s wrong. You just lost $40. Multiply this across hundreds of claims, and it’s real money.

External billing teams audit payments against contracted rates systematically. They catch discrepancies immediately. They pursue corrections aggressively. Your reimbursement matches your contracts.

The Follow-Up That Never Happens

You have $80,000 sitting in 60+ day accounts receivable. Your internal medical billing specialist knows she should follow up. But she’s buried in new claim submission. The aging claims sit. They age into 90+ days. Then 120+ days. Recovery becomes nearly impossible.

Industry data shows collection rates by aging:

- 0-30 days: 95% collection rate

- 31-60 days: 85% collection rate

- 61-90 days: 70% collection rate

- 91-120 days: 50% collection rate

- 120+ days: 25% collection rate

Every day claims age, you lose money. Professional billing and coding services have dedicated AR teams that work aged claims systematically. Nothing slips through. Collection rates stay above 85%.

The Write-Offs That Shouldn’t Happen

Your internal team writes off claims as uncollectible. Maybe they are. Maybe they’re not. Nobody has time to investigate thoroughly. You accept the loss and move on.

External billing teams don’t accept write-offs without a fight. They pursue every angle. They resubmit with corrections. They appeal. They follow up persistently. Claims you would have written off get paid.

The difference:

- Monthly write-offs (internal): $12,000

- Monthly write-offs (external): $4,000

- Monthly savings: $8,000

- Annual savings: $96,000

The Specialty-Specific Issues You’re Missing

If you run a dental practice, standard medical billers won’t cut it. Dental billing requires understanding:

- CDT code system vs CPT codes

- Tooth numbering and quadrant coding

- Pre-authorization requirements

- Waiting periods and frequency limitations

- Annual maximum tracking

- Coordination of benefits between medical and dental

General medical billing and coding staff miss these nuances constantly. Claims deny. Revenue is lost. Specialized dental billing services prevent this entirely.

The Insurance Verification That Dental Practices Need

Dental insurance verification is more complex than medical. You need to check:

- Active coverage status

- Annual maximum remaining

- Deductible status

- Waiting periods for major services

- Coverage percentages by service categories

- Pre-authorization requirements

Your front desk can’t do this thoroughly while managing everything else. Professional dental billing services verify comprehensively before every appointment. Patients know what they owe. You know what you’ll collect. Surprises disappear.

How External Billing Support Recovers That 30%

When you partner with comprehensive medical billing companies, every leak gets plugged:

Clean claim submission:

- Certified coders review every claim

- NCCI edits applied automatically

- Correct modifiers every time

- Medical necessity verified upfront

- Submission within 24-48 hours

Aggressive denial management:

- 95%+ of denials appealed

- Expert appeal letters

- Proper documentation every time

- Timely filing deadlines tracked obsessively

- 60-70% recovery rates

Proactive credentialing:

- All provider enrolments tracked

- Renewal applications submitted early

- Persistent payer follow-up

- Zero lapses in coverage

- New payer enrolment expedited

Systematic AR management:

- Daily follow-up on aged claims

- Payment posting audited against contracts

- Underpayments caught and corrected

- Collection calls handled professionally

- Write-offs minimized dramatically

Comprehensive front office support:

- Insurance verified before every visit

- Benefits confirmed, not just eligibility

- Financial responsibility discussed upfront

- Bad debt reduced by 60%+

- Patient satisfaction improved

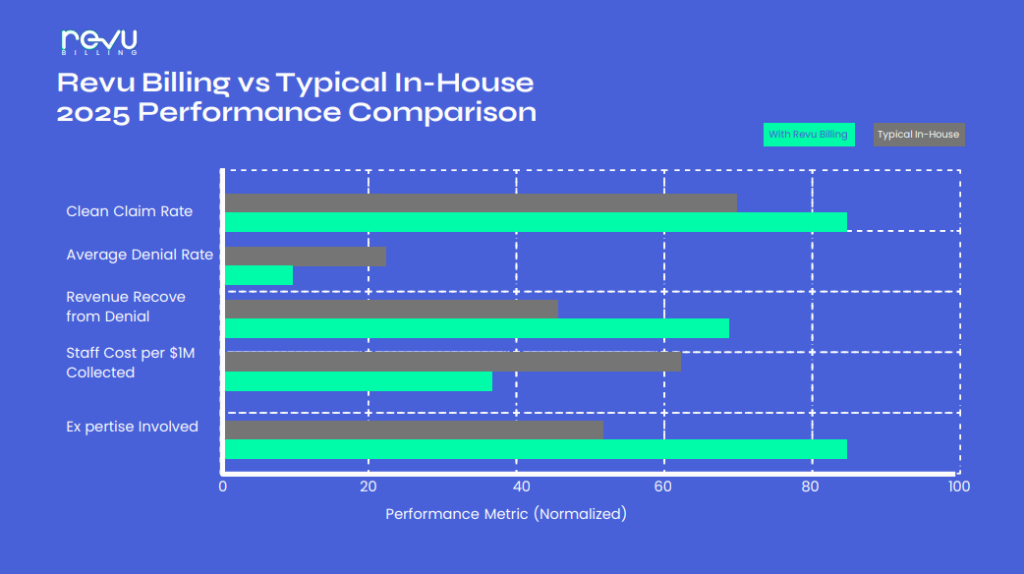

The practices that make this switch see immediate results:

- First month: Clean claim percentage jumps from 75% to 95%

- Second month: Denial recovery adds $15,000-$25,000

- Third month: Days in AR drop from 45+ to under 30

- Ongoing: Revenue increases 15-30% from plugging all leaks

Stop Leaving Money on the Table

You’re working too hard to lose 30% of your revenue to fixable problems. Every day you manage medical billing and coding internally is another day you’re leaving five figures on the table. Every denied claim that doesn’t get appealed. Every timely filing deadline that passes. Every underpayment that goes unnoticed. Every credentialing lapse that stops claims. It all adds up to massive, preventable losses.

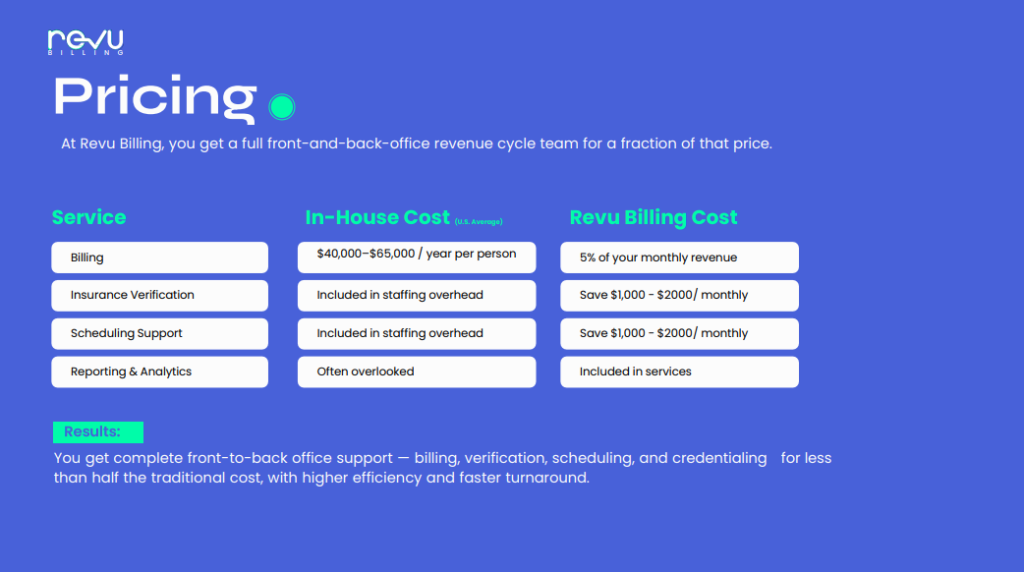

The math is simple. Calculate what 30% of your annual revenue equals. That’s what’s at risk. Now calculate what professional medical billing outsourcing costs. The difference is pure profit that should be in your bank account.

Your competitors who’ve already made this switch? They’re capturing that revenue. They’re growing while you’re struggling. They made the same decision you’re about to make. They just made it sooner.

Ready to stop losing revenue to preventable billing failures? RevuBilling provides comprehensive medical billing, dental billing, credentialing, front office management, and medical coding services that recover the revenue you’re currently leaving on the table.

Our certified medical billing and coding specialists plug every leak in your revenue cycle, from clean claim submission to aggressive denial management to systematic AR follow-up. See exactly how much revenue you’re losing to internal billing inefficiencies using our cost calculator at RevuBilling.com.

Stop accepting 70% of what you’ve earned. Start collecting 100%.